CREDIT ACTIVITY

GCC’s intervention

- Till 1990s, the tribal farmers were almost totally dependent on money lenders for their agricultural needs due to ineffective institutional credit flow and disinterest of the commercial banks on tribal areas owing to poor repayment capacity of the tribal farmers.

- GCC’s loaning strategy emerged in the given background and after its recognition as a District Cooperative Central bank and its affiliated GPCM Societies as PACs by NABARD vide its Ref.No.NB.Hyd/3118/Plan/H.51/90-91 dt.28.05.1990.

- Thereafter GCC secured credit limit from NABARD and extended short-term, Medium-Term and also Long-term loans to the tribal farmers after the year 1990.

- Due to continuous drought conditions and crop failure tribal farmers remain as chronic defaulters in repayment of loans to GPCMS.

- At this stage the Interest relief and Debt waiver packages sanctioned by the G.O.I and State Government have reduced the burden on the tribal farmers to greater extent. But the repayments by the tribal farmers to the GPCMS are badly suffered.

Loaning Strategy

- To concentrate on interior villages which are not effectively served by the commercial Banks and other lending Agencies.

- To extend crop loans at reasonable scale of finance suitable to the tribal farmers and thereby reducing the loan burden on them.

- To provide repayment facility to the tribal farmers in small amounts at their convenience in cash or through MFP/ SAP.

- D.R.Depot to function as a single window for loan disbursement and its collection through cash or produce.

Shop Online

Shop Online

Girijan Honey

Girijan Honey

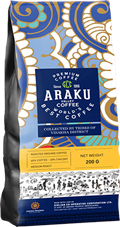

Araku Coffee

Araku Coffee

Turmeric Powder

Turmeric Powder

Triphala Churnam, Ras & Powder

Triphala Churnam, Ras & Powder

Aloevera Soap

Aloevera Soap

Jasmine International Soap

Jasmine International Soap

Neem International

Neem International

Turmeric Soap

Turmeric Soap

Flower Tamarind

Flower Tamarind

Rajmah

Rajmah

Cuttings

Cuttings

Ragi Flour

Ragi Flour

Nannari Sharbat

Nannari Sharbat

Bilwa Sharbat

Bilwa Sharbat

Chilli Powder

Chilli Powder

Kumkum Powder

Kumkum Powder

Black Pepper

Black Pepper

Cashew Nuts

Cashew Nuts

Amla Powder

Amla Powder

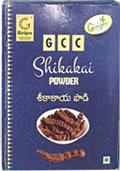

Shikakai Powder

Shikakai Powder

Soapnut Powder

Soapnut Powder

Shikakai Shampoo

Shikakai Shampoo

Soapnut Shampoo

Soapnut Shampoo

Soapnut Hair Wash

Soapnut Hair Wash

Herbal Dish Wash

Herbal Dish Wash

Herbal Floor Cleaner

Herbal Floor Cleaner

Herbal Hair Oil

Herbal Hair Oil

Herbal Pain Relief Oil

Herbal Pain Relief Oil